.

.

IN-V-BAT-AI solution to forgetting! No coding and no website hosting on your part.

Remember on demand is now possible!

Type here Using AI - Voice to Text Then tap SEARCH 2

Compute the Net Present Value

Compute the Net Present Value

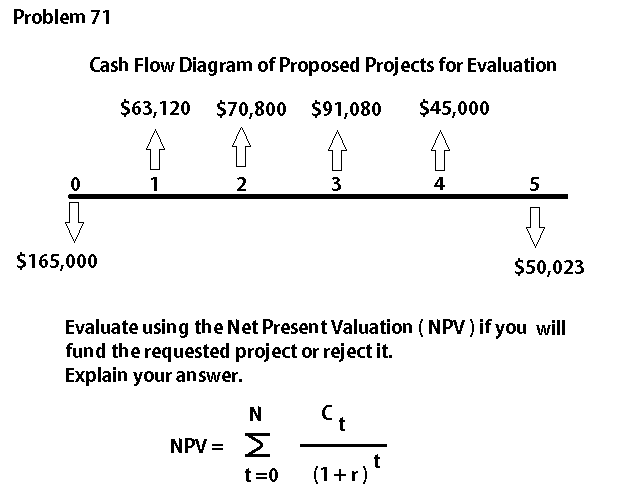

Cash flow diagram of proposed project for evaluation is shown below. Evaluate using the net present valuation (NPV) if you will fund the requested project or reject it. Explain your answer.

HOW TO USE: Select any input box. Answer will be automatic

You would like to make decision to fund the project or reject it. You are using the net present value ( NPV ) to help you in making decision. If the NPV is positive you will proceed to fund the project. If the NPV is negative you will reject the project.

Year = 0, means initial expected expenses to fund the project

The discount rate is at % for

year,

and your initial cash expenses $

at the end of year.

Initial cash flow expenses to fund the project =

Year = 1, means projected income after first year of the project

The discount rate is at % for

year,

and projected income for first year $

at the end of year.

Present value of cash flow income =

Year = 2, means projected income after second year of the project

The discount rate is at % for

year,

and projected income for second year $

at the end of year.

Present value of cash flow income =

Year = 3, means projected income after third year of the project

The discount rate is at % for

year,

and projected income for third year $

at the end of year.

Present value of cash flow income =

Year = 4, means projected income after fourth year of the project

The discount rate is at % for

year,

and projected income for fourth year $

at the end of year.

Present value of cash flow income =

Year = 5, means projected expenses after fifth year of the project

The discount rate is at % for

year,

and projected expenses for fourth year $

at the end of year.

Present value of cash flow projected expenses =

The NPV formula is telling you to add all the projected expenses or income at 12% borrowing rate

Year 0 = -165,000 +

Year 1 present worth value of income projected at present using 12% borrowing rate = 56,357 +

Year 2 present worth value of income projected at present using 12% borrowing rate = 56,441 +

Year 3 present worth value of income projected at present using 12% borrowing rate = 64829 +

Year 4 present worth value of income projected at present using 12% borrowing rate = 28,598 +

Year 5 present worth value of expenses projected at present using 12% borrowing rate = -28,384

After simply adding the total expenses and income projected at present value using bank borrowing rate of 12% you will get the Net Present Value of the money. Usually the bank rate is lock for the year of the project so there is no uncertainty. If the bank interest rate is fluctuating there is no certainty, some money lender will add safety factor by offering higher interest rate. Example is the personal loan lender, when they fund a borrower with no collateral there is no certainty that they can get some portion of the principal money that they approved for a personal loan. So they add safety factor by using higher interest rate so they can collect faster their money. When unfortunate event happens to a borrower towards the end of their loan period, they probably collected their principal plus earned interest.

Net Present Value (NPV) =

If the NPV is positive fund the project. Otherwise reject the funding request.

Formula Recall

Where C = means Future Cash Income or Expenses Projected

Where NPV = means Net Present Value

Where r = means discounted rate for C

Where N = means number of years money is discounted for present value

NPV = Σ C ( 1 + r ) - N

The initial pattern of solving this type of problem is remembering the formula. Next mastering how to use your personal online calculator. Now you have your tool for computational thinking. You can do quick analysis. For example you can adjust the discounting rate to 6% , then enter the projected income and expenses. Tip do not enter dollar $ sign or comma symbol because you will get an error message of NaN, meaning Not a Number data entry.

Practice using your online personal calculator by using the data shown below.

| Discounting rate | 6% |

| Initial Cash Expenses | 300,000 |

| 1st year income | 63,120 |

| 2nd year income | 70,800 |

| 3rd year income | 91,080 |

| 4th year income | 45,500 |

| 5th year expenses | 50,000 |

.

IN-V-BAT-AI helps you recall information on demand—even when daily worries block your memory. It organizes your knowledge to make retrieval and application easier.

Source: How People Learn II: Learners, Contexts, and Cultures

.

How can IN-V-BAT-AI be used in classrooms ?

IN-V-BAT-AI is a valuable classroom tool that enhances both teaching and learning experiences. Here are some ways it can be utilized:

⋆ Personalized Learning : By storing and retrieving knowledge in the cloud, students can access tailored resources and revisit

concepts they struggle with, ensuring a more individualized learning journey.

⋆ Memory Support : The tool helps students recall information even when stress or distractions hinder their memory, making it

easier to retain and apply knowledge during homework assignments or projects.

⋆ Bridging Learning Gaps : It addresses learning loss by providing consistent access to educational materials, ensuring that

students who miss lessons can catch up effectively.

⋆ Teacher Assistance : Educators can use the tool to provide targeted interventions to support learning.

⋆ Stress Reduction : By alleviating the pressure of memorization, students can focus on understanding and applying concepts,

fostering a deeper engagement with the material.

🧠 IN-V-BAT-AI vs. Traditional EdTech: Why "Never Forget" Changes Everything

📚 While most EdTech platforms focus on delivering content or automating classrooms, IN-V-BAT-AI solves a deeper problem: forgetting.

✨Unlike adaptive learning systems that personalize what you learn, IN-V-BAT-AI personalizes what you remember. With over 504 pieces of instantly retrievable knowledge, it's your cloud-based memory assistant—built for exam prep, lifelong learning, and stress-free recall.

- ✅ One-click access to formulas, calculators, and concepts

- 📧 No coding, no hosting—just email what you want to remember

- 📱 Live within 24 hours, optimized for mobile and voice search

- 💸 $30/year for 504 personalized knowledge sites (just 6¢ each)

"🧠 Forget less. Learn more. Remember on demand."

That's the IN-V-BAT-AI promise.

Personal Augmented Intelligence (AI) Explanation

🧠 Augmented Intelligence vs Artificial Intelligence

Understanding the difference between collaboration and automation

🔍 Messaging Contrast

Augmented Intelligence is like a co-pilot: it amplifies your strengths, helps you recall, analyze, and decide — but it never flies solo.

Artificial Intelligence is more like an autopilot: designed to take over the controls entirely, often without asking.

💡 Why It Matters for IN-V-BAT-AI

IN-V-BAT-AI is a textbook example of Augmented Intelligence. It empowers learners with one-click recall, traceable results, and emotionally resonant memory tools. Our “Never Forget” promise isn't about replacing human memory — it's about enhancing it.

Note: This is not real data — it is synthetic data generated using Co-Pilot to compare and contrast IN-V-BAT-AI with leading EdTech platforms.

.

.

.

🎉 50,000 Visitors Strong

IN-V-BAT-AI just crossed 50,000 organic visits—no ads, just curiosity and word-of-mouth.

Every visit is a step toward forgetting less, recalling faster, and remembering on demand.

Never Forget. Learn on demand.

SubscribeTry AI website hosting

$30 per year

| Year | Top 10 countries | Pages visited |

| 2023 | 1. USA 2. Great Britain 3. Germany 4. Canada 5. Iran 6. Netherlands 7. India 8. China 9. Australia 10. Philippines | 127,256 Pages / 27,541 Visitors |

| 2024 | 1. USA 2. China 3. Canada 4. Poland 5. India 6. Philippines 7. Great Britain 8. Australia 9. Indonesia 10. Russia | 164,130 Pages / 40,724 Visitors |

| Daily Site Visitor Ranking 10/10/2025 | 1. USA 2. Brazil 3. Vietnam 4. Canada 5. India 6. Argentina 7. Morocco 8. Japan 9. Indonesia 10. Ecuador | Year to Date 166,990 Pages / 55,839 Visitors |

Data source: Advanced Web Statistics 7.8